How to maximize your Capital One miles: From booking travel to redeeming rewards

With an impressive list of 15-plus transfer partners for select Venture and Spark cardholders, Capital One miles transfer to many of the same valuable travel partners as Chase Ultimate Rewards points, Citi ThankYou Rewards points and American Express Membership Rewards points.

Capital One also allows you multiple options to redeem your miles at a fixed rate.

Here are the best strategies for maximizing your return on Capital One miles.

Earning Capital One miles

Here are the six Capital One cards that earn Capital One miles:

| Card | Annual fee | Welcome offer | Notable perks |

|---|---|---|---|

| Capital One Venture Rewards Credit Card | $95 | Earn 75,000 bonus miles after spending $4,000 on purchases within the first three months from account opening, plus a $250 Capital One Travel credit to use in your first cardholder year. | 2 miles per dollar spent on purchases, no foreign transaction fees, Global Entry/TSA PreCheck application fee credit (up to $120) |

| Capital One Venture X Rewards Credit Card | $395 | Earn 75,000 bonus miles once you spend $4,000 on purchases within the first three months from account opening. | 2 miles per dollar spent on purchases, Global Entry/TSA PreCheck application fee credit (up to $120), no foreign transaction fees, extended warranty protection, Priority Pass Select membership, Capital One Lounge access and 10,000 annual bonus miles |

| Capital One Venture X Business | $395 | Earn 150,000 miles once you spend $30,000 in the first three months from account opening. | 2 miles per dollar spent on purchases, annual $300 Capital One Travel credit, 10,000 annual bonus miles and Global Entry/TSA PreCheck application fee credit (up to $120) |

| Capital One VentureOne Rewards Credit Card | $0 | Earn 20,000 bonus miles once you spend $500 within the first three months from account opening. | 1.25 miles per dollar spent on all purchases |

| Capital One Spark Miles for Business | $0 introductory annual fee the first year, then $95 | Earn 50,000 bonus miles after you spend $4,500 on purchases within the first three months from account opening. | 2 miles per dollar spent on all purchases |

| Capital One Spark Miles Select for Business | $0 | Earn 50,000 miles after you spend $4,500 on purchases within the first three months from account opening. | 1.5 miles per dollar spent on all purchases, free employee cards |

The information for the Capital One Spark Miles Select has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Related: Best Capital One credit cards

How to redeem Capital One miles

You have two broad options for redeeming your Capital One miles: for a fixed value or transferring them to airline and hotel partners.

Transferring will usually get you a better value. Still, the ability to mix and match redemptions to suit your travel needs gives Capital One a unique edge over the competition.

Fixed-value rewards

Capital One provides a few options for getting a fixed-value return when you redeem your miles. However, not all options will provide an equal return.

Daily Newsletter

Reward your inbox with the TPG Daily newsletter

Join over 700,000 readers for breaking news, in-depth guides and exclusive deals from TPG’s experts

Redeem for Amazon and PayPal purchases

When you use your miles to pay with Amazon and PayPal, you’ll get 0.8 cents per mile. You can link your Amazon account here and your PayPal account here.

Redeem for recent travel

You can use your miles to redeem for recent eligible travel purchases made in the last 90 days on your Venture or Spark card at a fixed rate of 1 cent each. There’s no minimum redemption amount. You can redeem for purchases made with airlines, hotels, rail lines, car rental agencies, limousine services, bus lines, cruise lines, taxi cabs, travel agents and timeshares.

Book new travel

You can book new travel through Capital One and redeem your miles at the same value of 1 cent each, but this would prevent you from double-dipping with any rewards program offered by an online travel agency. Remember that booking hotels through a third-party site (including Capital One) would likely prevent you from earning points and enjoying applicable elite status perks. As a result, you’re likely better off booking travel directly and then redeeming miles toward those charges.

Redeem for gift cards

You can use your Capital One miles for gift cards at the same rate of 1 cent per mile, but since gift cards can often be purchased on sale, redeeming miles to cover travel purchases is a better option.

Redeem for cash back

You should do everything possible to avoid this option, as it will only provide a redemption value of 0.5 cents per mile.

The Premier Collection

The Premier Collection, available exclusively to Venture X and Venture X Business cardholders, provides premium perks like room upgrades, free breakfast, early check-in, late checkout and a $100 on-property credit at boutique and luxury hotels when booked through this platform. If you redeem your miles for a Premier Collection hotel, you’ll get just 1 cent per mile, though the on-property perks may make for a better redemption. While Capital One doesn’t guarantee you’ll earn points and status qualification through hotel loyalty programs, you can always try adding your loyalty number before (or at) check-in.

If you don’t want to play around with transfers, consider redeeming your Capital One miles at a fixed value. The process is relatively easy and doesn’t require jumping through any hoops.

Here’s a step-by-step guide showing how to use your Capital One miles at a fixed value.

How to redeem Capital One miles at a fixed value

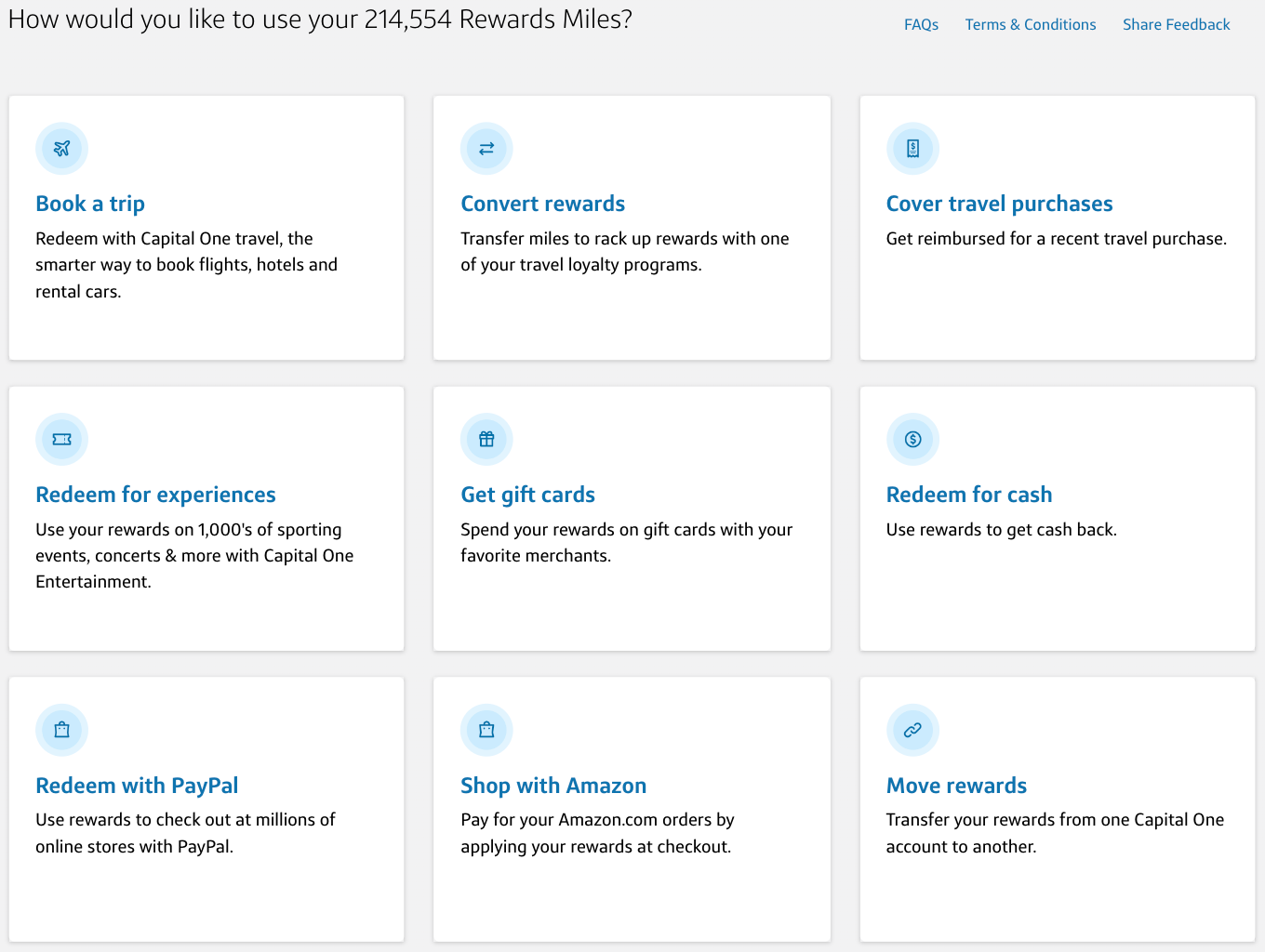

First, sign in to your Capital One account and click on your mileage balance. There, you’ll see several fixed-value redemption options — you can use your miles for travel, gift cards, cash, Amazon, PayPal and experiences, or transfer them to another account.

When redeeming miles for travel, you can either book new travel or use the miles as a statement credit against previous travel purchases. Regardless of your route, the redemption rate when using miles for travel is 1 cent per mile.

Transfer to airline and hotel partners

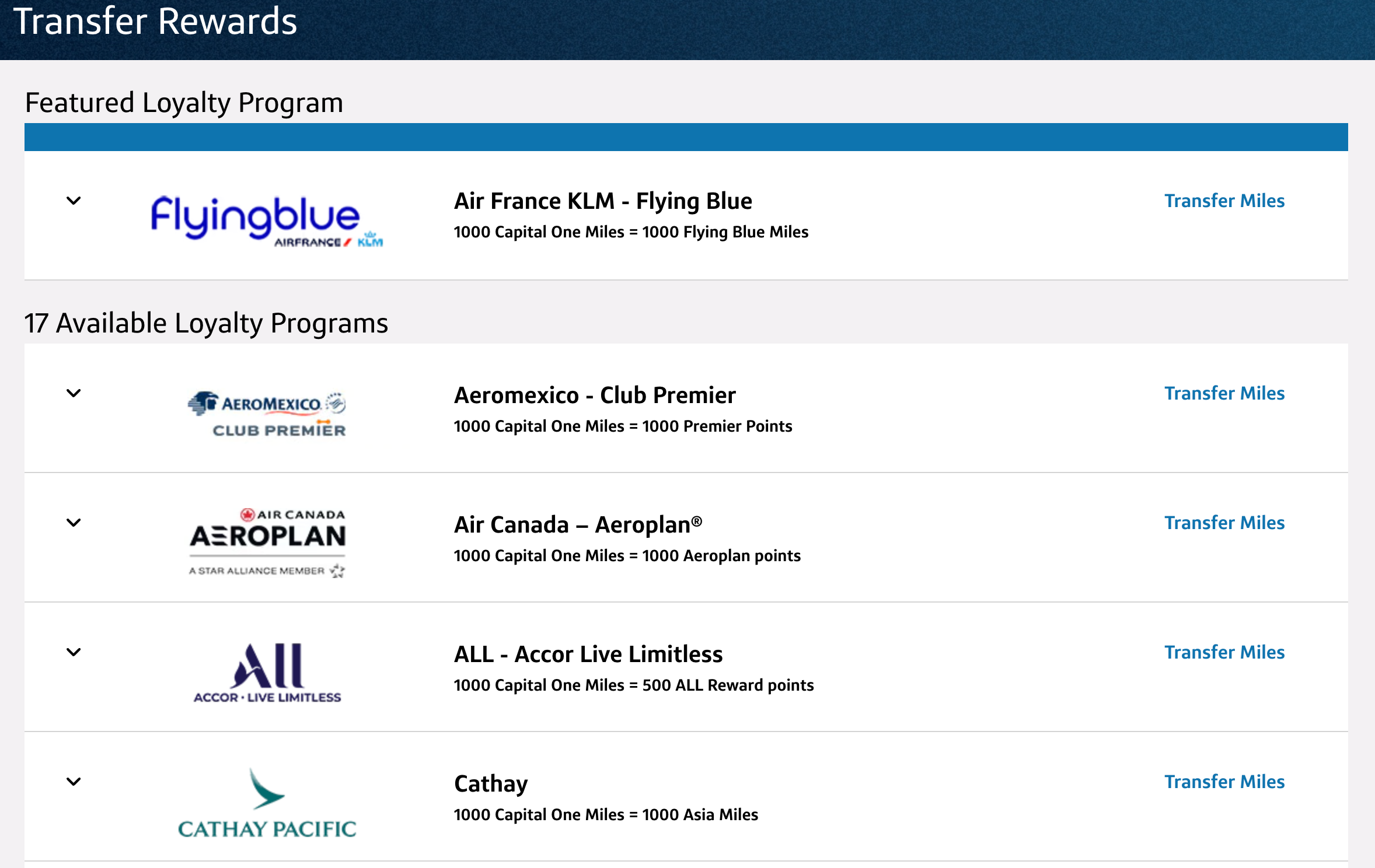

If you want higher value for your miles, transferring to partners may be your best bet. Select “Convert rewards.” From here, you can transfer your rewards to more than 15 airline and hotel loyalty programs.

Here’s an overview of the program’s airline transfer partners, most of which have a 1:1 transfer ratio.

| Program | Transfer ratio |

|---|---|

| Aeromexico Rewards | 1:1 |

| Air Canada Aeroplan | 1:1 |

| Air France-KLM Flying Blue | 1:1 |

| Avianca LifeMiles | 1:1 |

| British Airways Executive Club | 1:1 |

| Cathay Pacific Asia Miles | 1:1 |

| Emirates Skywards | 1:1 |

| Etihad Airways Guest | 1:1 |

| EVA Airways Infinity MileageLands | 2:1.5 |

| Finnair Plus | 1:1 |

| JetBlue TrueBlue | 5:3 |

| Qantas Frequent Flyer | 1:1 |

| Singapore Airlines KrisFlyer | 1:1 |

| TAP Air Portugal Miles&Go | 1:1 |

| Turkish Airlines Miles&Smiles | 1:1 |

| Virgin Red | 1:1 |

Given the earning rate of 2 miles per dollar spent on the Spark and Venture cards, you can effectively think of them as usually earning 1.5 or 2 partner airline miles per dollar spent, depending on the partner.

Here’s an overview of the program’s hotel transfer partners:

| Program | Transfer ratio |

|---|---|

| ALL — Accor Live Limitless | 2:1 |

| Choice Privileges | 1:1 |

| Wyndham Rewards | 1:1 |

Since Accor is a revenue-based program, there’s no way to get outsize value from those rewards.

Choice Privileges and Wyndham Rewards do offer some solid redemptions, though other hotel programs tend to be more rewarding.

Redeeming miles for travel vs. transferring to airlines

Capital One’s Venture and Spark cards have always allowed cardholders to redeem miles for travel; you can redeem your miles for 1 cent each as statement credits toward any travel purchase you’ve made within the last 90 days. So, how do you decide when to transfer miles and when to redeem them for travel? Let’s say you’re booking a domestic flight:

- Cost: If you find any domestic fares for $120 round-trip or less, it’s probably best to redeem miles for travel as a statement credit instead of transferring them to an airline that would charge 12,000 miles for the same ticket.

- Award availability: Next, look for award availability at the lowest mileage levels using the major domestic carriers’ websites (American Airlines, Delta Air Lines and United Airlines) or ExpertFlyer (owned by TPG’s parent company, Red Ventures). When you find saver-level award space, you can use the chart above to see how many Capital One miles you’ll need to transfer to the airline.

- Factor in mileage earning and upgrade opportunities: When you redeem miles for travel, you can book tickets as you normally do. That means you can earn miles from the flight and credit toward elite status. If you currently hold airline elite status, you should still enjoy all of your elite status benefits, including being eligible for upgrades. You may not receive those benefits when transferring your Capital One miles to a partner.

- Consider taxes and fees: All frequent flyer programs will add Transportation Security Administration taxes, a minimum of $5.60 each way on nonstop, domestic flights. However, some programs tack on hefty surcharges on top of that.

Maximizing Capital One’s airline transfer partners

In our February 2025 valuations, TPG values Capital One miles at 1.85 cents apiece, thanks to the value you can get by transferring to a handful of partner programs.

Air Canada Aeroplan

Air Canada’s loyalty program, Aeroplan, has long been one of the most popular options for booking Star Alliance awards, especially in premium cabins. After United switched to dynamic award pricing, it’s been more important than ever to leverage foreign partners with award charts that set fixed mileage prices, and Aeroplan is a great option.

Sweet spots include flights under 500 miles in length in economy class for just 6,000 Aeroplan points. Or, you can book transcontinental business-class awards from just 25,000 points each way — well below what United would charge if you booked through its MileagePlus program.

How about business class to Western Europe from the Northeast from just 60,000 Aeroplan points?

Additionally, you can book Emirates award tickets using Aeroplan points.

Air France-KLM Flying Blue

Flying Blue offers flights to Europe on Air France or KLM, regardless of origin or destination (including connections), from as little as:

- 25,000 miles in economy

- 40,000 miles in premium economy

- 60,000 miles in business class

Related: Is KLM premium economy worth it on the 787 Dreamliner?

Finnair Plus

You might never plan to travel to Finland or Northern Europe, but Finnair Plus is a great choice for your Capital One miles thanks to its membership in the Oneworld alliance.

Finnair Plus offers domestic flights anywhere within the continental United States and Canada for just 11,000 Avios when flying Alaska Airlines in economy class. Whether you’re looking to fly within the Pacific Northwest or across the country, this is an excellent deal for many thousands of miles of distance flown, plus minimal fees, taxes and surcharges.

Transferring Capital One miles to hotels

You can also transfer Capital One miles to the following three hotel loyalty programs:

This could be an appealing option if you plan on staying at an Accor property, including one of its higher-end Fairmont hotels. The program uses a fixed-value redemption scheme where you can redeem 2,000 points for a 40-euro (about $42) discount on your hotel stay. Since you’d need to transfer 4,000 Capital One miles to get 2,000 ALL points, transferring points will give you a slightly higher redemption value (1.05 cents apiece).

In our February 2025 valuations, we value Wyndham points at 1.1 cents apiece, though following our guide might result in a better redemption.

Meanwhile, Choice Privileges can also provide solid value. The program generally charges between 6,000 and 35,000 points for an award night, though some hotels can cost up to 87,000 points per night. You usually won’t get great value for your points when redeeming at these high points costs.

Bottom line

Capital One miles have become much more valuable over the last few years thanks to new transfer partners, improved transfer ratios and elevated welcome bonuses on its credit cards. Miles transfer to almost all airline partners at a 1:1 ratio, which is phenomenal, considering the welcome offer for the Capital One Venture Rewards Credit Card is 75,000 bonus miles after you spend $4,000 on purchases within the first three months from account opening, plus a $250 Capital One Travel credit to use in your first cardholder year.

With 15-plus transfer partners, Capital One offers one of the most flexible transferable currencies. The beauty of Capital One miles comes from the ability to combine transfer partner redemptions with fixed-value redemptions to suit your travel needs.